Other big grain-producing countries like the US, Canada, and Brazil are facing drought

By Yaduvendra Mathur

In these confusing and challenging times, news of Sri Lankan nationals including children fleeing to the southern Indian state of Tamil Nadu on fishing boats to escape hunger caused by acute shortages of fuel, food, and medicines, points towards a frightening global fragility.

Initially hit by the pandemic, the situation in Colombo has indeed worsened after Russia attacked Ukraine last month. Sri Lanka depends on imports for essential items, but depleted foreign exchange reserves, not the war alone, led them to this sorry situation.

Meanwhile, India’s highest ever goods exports of $400 billion – up from $292 billion in 2020-21 – showcase the country’s rising economic heft but not necessarily stronger regional supply chains. This war in Europe is a lesson for all countries in the world to work on rebuilding regional supply chains – especially for food, medicines, and most important – for energy needs.

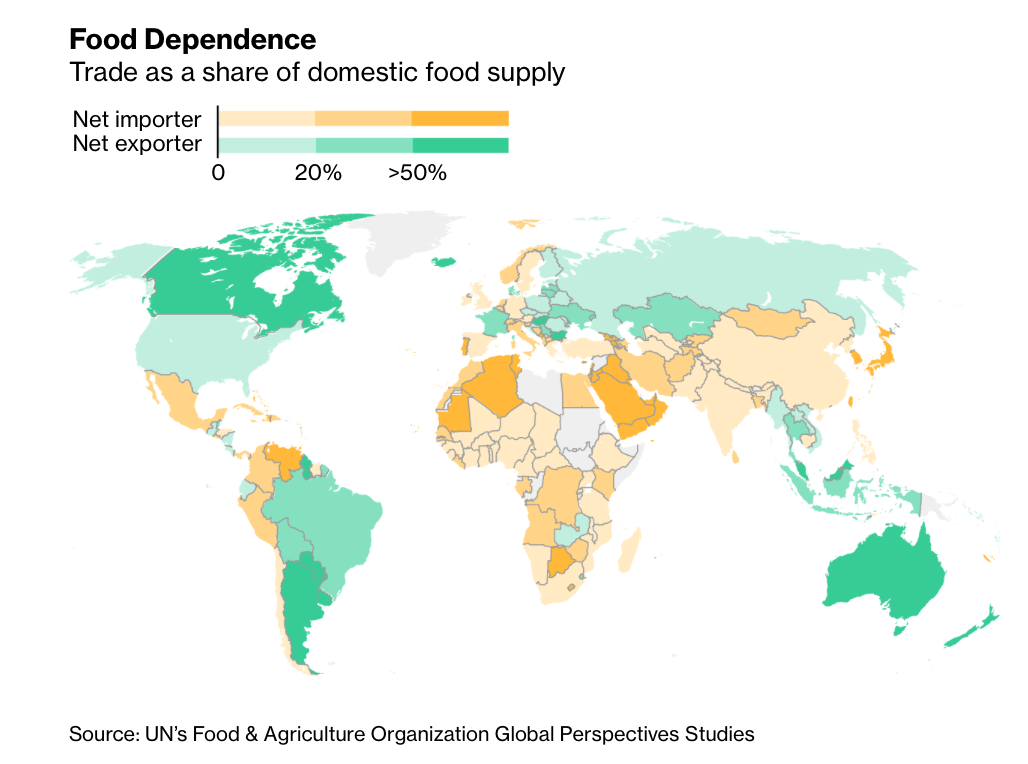

Admittedly, 13 percent of global calories came out of production when Russian and Ukrainian borders were shut down. This is a major disruption that could “trigger unrests like the Arab Spring.” With 29 percent of global wheat exports, 19 percent of world corn supplies, and 80 percent of world sunflower oil exports, Russia and Ukraine being shut out of the global calorie production, is a never seen before scenario playing out in real-time. Around 70 percent of Russian wheat exports went to buyers in the Middle East and Africa.

Compounding this war is a series of events like the Argentinian drought or very dry weather in the US, Canada, and Brazil – all the big grain-producing countries that reported below-average production this year.

The cost of procuring and shipping food across the globe is now a rather speculative and tricky business. The Russian invasion of Ukraine has put an end to the globalization we have experienced over the last three decades. With prices of key staples spiking, governments are safeguarding domestic supplies for their own people. Bloomberg reports about how global crop trading has been roiled and warns of another threat building: Food protectionism.

Protectionism means food inflation due to supply shocks. Turkey, Iran, Egypt, Saudi Arabia, and Nigeria are among the top buyers of Russian grain. Lebanon imports 50 percent of its total wheat consumption from Ukraine, followed by Libya at 43 percent, Yemen at 22 percent, and Bangladesh at 21 percent. Asia’s love for rice and not wheat will surely limit the fallout of this war.

Disruptions in the food supply chains cause inflation which in turn impacts the poor and vulnerable populations most severely. Sooner than later, essential supermarket shopping shall need some form or the other of state support in most parts of the world through government subsidies. This was started in India under the “Garib Kalyan Scheme” during the peak of the first wave of Covid-19 and continues even today.

Every threat is an opportunity – for ringing in efficiency gains – and better targeting and implementation of efficient regional food supply chains in South Asian countries. Sri Lanka and India are quickly setting up a renewed development partnership framework for ensuring such a resilient supply chain – for food, petroleum, and other essential supplies, replacing a usurious rent-seeking country from intervening maliciously.

Global Oil supply and Russian roulette

Can Canada the fourth biggest oil producer replace Russia? The Canadians have promised to add 300,000 barrels per day soon – yet these need transportation through the US pipeline system to be shipped to Europe. The recent meeting in Paris of Energy Ministers appears to be just a show of solidarity.

The preparation for the unknown – in the context of a faltering neoliberal world order – one increasingly seen as fragile, inefficient, short-sighted, and unable to respond to the crisis – that the war in Ukraine has so further destabilized global production and investor confidence along with consumer confidence. In other words, when it comes to economic forecasting, the assumption is that “the world will simply continue to spin as untenable as it ever has been in living memory.”

Atma Nirbhar India: A Global Player

India has embarked on a path of “Atma Nirbhar” – a resilient economy that considers the world as a community it serves. India is well poised to fill the gap in global food value chains. According to the Jan 2022 figures, India’s exports of agricultural commodities and processed foods grew 23 percent year-on-year basis during 201-22. It indicates the continued strength of the segment in the country’s export basket. Moreover, the value of wheat shipments increased by more than 387 percent from April 2021 – to January 2022. Volume-wise wheat exports increased to a record 6 million tons from 1.3 million tons shipments last year.

Although India is not among the top 10 wheat exporters in global trade, the growth rate of exports of this commodity is higher than that of Russia, Ukraine, and the US. The export targets for the current financial year have been achieved and with the export of agriculture and processed food products at $20,673 million with an estimated shipment of more than 22 Million tons, India is likely to continue to be a major part of the global rice trade with a growth of over 24 percent from the previous year. Export of meat, dairy and poultry products has also grown rapidly as have also the exports of fruits and vegetables that have grown by 16 percent in the current year as compared to the previous year.

In the long run, global food supply chains shall have to increase resilience by balancing investments in dedicated teams processes, and technologies that will enable their organizations to implement end-to-end risk management. This includes tactics like deploying strategic redundancies that not only drive competitiveness but also secure critical value networks and supply ecosystems. What this type of risk tolerance will therefore look like for retailers and supply chain experts is broadly speaking an abundance of caution, even at the cost of short-term profit if businesses are forward-thinking. Preparing for a difficult future of food value chains by making the necessary sacrifices now is better than one of the next global shock’s first victims.

(The writer is a 1986 batch IAS officer. He retired as Special Secretary, NITI Aayog. Mathur is a specialist in development finance and was CMD of Export-Import Bank of India. He had been associated with the BRICS Development Bank, and represented India at the Board level of the African Development Bank.)