Intro: At the beginning of this year, many economists predicted a mild recession in the US, a deeper one in Europe, and a robust rebound in China. There was no recession in the US, Europe managed well and China is struggling to regain its footing. Meanwhile, The Indian economy is expected to grow 7.3 per cent in the current fiscal year.

Taming inflation with rising rates

Central banks around the world increased interest rates across 2023 to try and tackle inflation, while attempting to balance this with a need to maintain growth.

Come the tail end of the year, many central banks have paused rate rises, with the European Central Bank, US Federal Reserve and the Bank of England all holding rates.

Many central banks haven’t ruled out further rises next year, though, should they be necessary.

The US inflation rate is seen easing closer to the Federal Reserve’s 2 per cent target in 2024 in the latest forecast from the Congressional Budget Office, as economic growth and labor market activity cools.

As the US inflation has been cooling of late, market participants are buying stocks aggressively, expecting the US Federal Reserve to start cutting interest rates as early as March next year.

US shutdown scare

Throughout 2023, the Democrats and Republicans repeatedly clashed over budgetary matters in the US. The country came very close to a government shutdown in October 2023.

This came after an intense debate between the Democrats and Republicans over budget allocations. Earlier in the year, too, a confrontation over government expenditure had risked plunging the nation into a debt crisis.

Amid the buzz of a partial US shutdown on October 1, 2023, the Indian stock market opened with an upside gap and went on to extend its early morning gains further. However, it later witnessed a sharp correction.

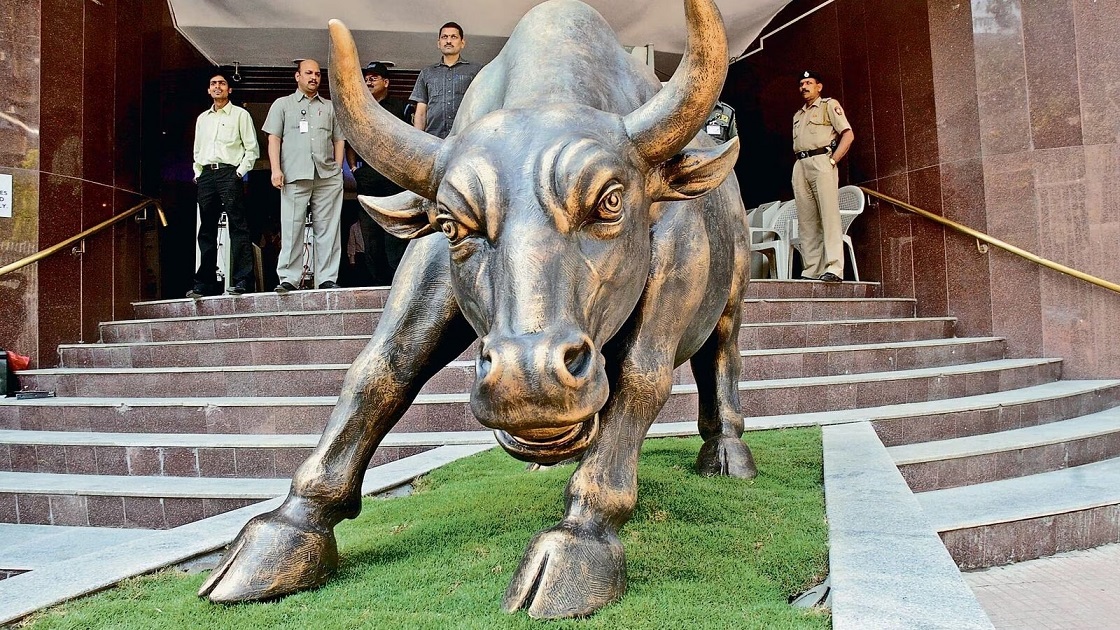

Indian market touched an all-time high

Benchmark index Nifty-50 scaled an all-time high level, and hit its fresh record high of 21,675.75 during the session on December 27.

The Sensex opened at 71,492.02 against the previous close of 71,336.80 and hit its fresh record high of 72,119.85 during the trade.

With this, the Indian market cap touched $4 trillion for the first time in December. India is now the fifth-largest market in the world and stands tall among global economies. Only the US, China, Japan, and Hong Kong markets are currently ahead of India.

2023 has been the year of the IPO. The total number of IPOs this year crossed last year’s tally, with 173 small and medium-sized enterprises (SMEs) and 56 mainboard listings to date.

DIIs and FIIs invested $12 billion and $23 billion, respectively, in the Indian equity market till December 22. After being net sellers in FY22 and FY23, FIIs regained confidence in FY24 and the sentiment was further reinforced by the BJP’s big-bang performance in the Assembly elections across three key states out of the four in the fray.

Adani-Hindenburg row

Adani Group’s troubles started after a report issued by Hindenburg late on January 24, 2023, claimed that many shareholders of Adani Group companies were offshore shell companies and funds were tied to the group itself.

Index funds and exchange-traded funds (ETFs) tracking the Nifty Next 50 Index corrected sharply in two weeks after the report came in. The index dropped by 7.4 per cent. The reason for this was that Adani Group stocks, which accounted for 14 per cent weightage in the index, came under heavy selling pressure after the Hindenburg report.

The Supreme Court has now dismissed reliance on the Hindenburg report and affirmed faith in SEBI’s handling of the case.

Gautam Adani has reclaimed the Asia’s richest person spot after beating Mukesh Ambani as shares of his company show major growth.

Funding winter continues for startups, layoffs are on

Citing the global macroeconomic conditions, Big Tech firms and startups across the spectrum sacked employees, and layoffs continue to happen.

According to the latest data from layoff.fyi, a website that tracks tech sector job cuts, 1,178 tech companies laid off 260,771 lakh employees in 2023 alone.

On average, about 582 employees lost their jobs every day in the last two years – or more than 24 workers every hour.

Funding in India’s tech startup ecosystem in 2023 has been the lowest in the last five years. The year received $7 billion in total funding, a significant decline of 72 per cent, compared to $25 billion in the previous year.

Only two new unicorns were created this year — Incred and Zepto — as against 23 in the previous year and 119 acquisitions as compared to 187 acquisitions in 2022, a 36 per cent drop, according to the report by leading global market intelligence platform Tracxn.

The funding declined across all stages, with late-stage funding dropping over 73 per cent, followed by early-stage funding (70 per cent) and seed-stage funding (60 per cent).

Investments by private equity (PE) and venture capital (VC) funds to homegrown companies declined to $27.9 billion across 697 transactions this year (as of December 20), compared to $47.62 billion across 1,364 deals in 2022.

Go First insolvency: From skies to the ground

Go First was one of the biggest names in the Indian aviation sector until it wasn’t. On May 2, the airline said it was filing for voluntary insolvency proceedings and grounded its entire fleet.

The resolution process was initiated and several banks stated that no more funds should be given to Go First.

The airline blamed “faulty” engines by Pratt & Whitney and sought compensation. Its promoter, Nusli Wadia, recently said that the engines caused a loss of Rs 10,000 crore to the airline. The promoters also infused Rs 3,200 crore in the airline but it hasn’t flown a single flight since May.

SpiceJet, another domestic carrier, has expressed its interest in acquiring Go First. However, there has been no final decision on either the acquisition or the insolvency.