Mumbai: India’s Reserve Bank has initiated several liquidity boosting measures to combat economic turbulence unleashed by the resurgence of Covid-19.

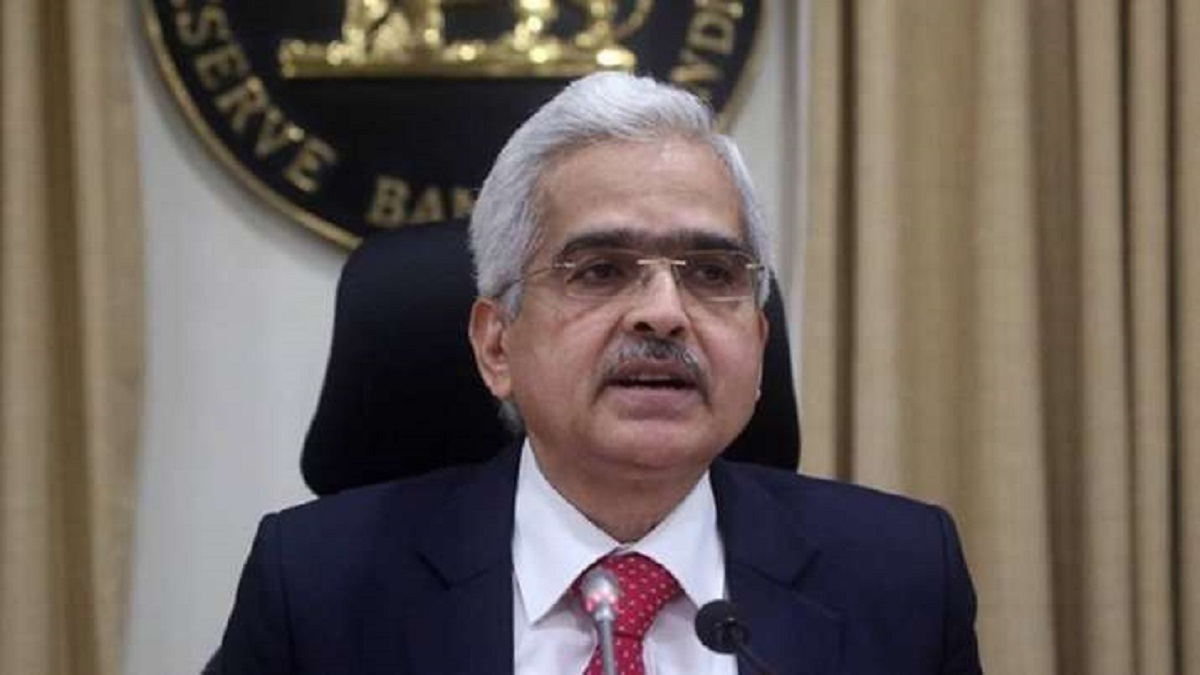

In a virtual address, RBI Governor Shaktikanta Das announced a number of liquidity enhancement and targeted measures to ease the build of economic strain seen recently.

“As in the recent past, the Reserve Bank of India (RBI) will continue to monitor the emerging situation and deploy all resources and instruments at its command in the service of the nation, especially for our citizens, business entities and institutions beleaguered by the second wave,” he said.

“The devastating speed with which the virus affects different regions of the country has to be matched by swift-footed and wide-ranging actions that are calibrated, sequenced and well-timed so as to reach out to various sections of society and business, right down to the smallest and the most vulnerable.”

Accordingly, RBI will conduct the second purchase of G-Secs worth Rs 35,000 crore on May 20.

“Domestic financial conditions remain easy on abundant and surplus system liquidity. The average daily net liquidity absorption under the liquidity adjustment facility (LAF) was at Rs 5.8 lakh crore in April 2021,” Das said.

“G-SAP has engendered a softening bias in G- sec yields which has continued since then… With system liquidity assured, the RBI is now focusing on increasingly channelising its liquidity operations to support growth impulses, especially at the grassroot level.”

The first auction under G-SAP 1.0 was conducted on April 15, 2021 for a notified amount of Rs 25,000 crore.

Besides, RBI announced a targeted on-tap liquidity window of Rs 50,000 crore to set up Covid-related healthcare infra till March 31, 2022.

“Under the scheme, banks can provide fresh lending support to a wide range of entities including vaccine manufacturers; importers or suppliers of vaccines and priority medical devices; hospitals or dispensaries; pathology labs; manufactures and suppliers of oxygen and ventilators; importers of vaccines and Covid related drugs; logistics firms and also patients for treatment.”

“Banks are being incentivised for quick delivery of credit under the scheme through extension of priority sector classification to such lending up to March 31, 2022. These loans will continue to be classified under priority sector till repayment or maturity, whichever is earlier.”

According to Das, banks may deliver these loans to borrowers directly or through intermediary financial entities regulated by the RBI.

Furthermore, the Reserve Bank will allow restructuring for borrowers with exposure of Rs 25 crore, who have not been beneficiaries of RBI’s previous loan restructuring schemes.

BOX

RBI extends video KYC to new customers

Mumbai: The Reserve Bank of India did not stop at providing liquidity enhancement measures to tackle the current economic strain unleashed by the resurgence of a Covid-19 wave. It also rationalised certain compliance matters to provide ease of doing business for consumers.

Accordingly, RBI governor Shaktikanta Das, in his virtual address on Wednesday also announced rationalisation of compliance to KYC requirements.

Taking forward the initiatives of the apex bank for enhancing customer convenience, it has now been decided to rationalise certain components of the extant KYC norms including extension of the scope of video KYC known as V-CIP (video-based customer identification process) for new categories of customers such as proprietorship firms, authorised signatories and beneficial owners of Legal Entities and for periodic updation of KYC.

The easing of compliance measures also includes conversion of limited KYC accounts opened on the basis of Aadhaar e-KYC authentication in non face-to-face mode to fully KYC-compliant accounts. Also, the RBI has allowed the use of KYC Identifier of Centralised KYC Registry (CKYCR) for V-CIP and submission of electronic documents (including identity documents issued through DigiLocker) as identity proof.

Banks have also been asked to introduce more customer-friendly options, including the use of digital channels for the purpose of periodically updating KYC details of customers.